What Type of Forex Trader Are You?

There are many various sorts of forex traders, and each one requires a unique technique. Whether you like the fast-paced sprint of day trading or the long-distance marathon of position trading, choosing the correct trading style for you will increase your chances of being successful in the market. Continue reading to find out more about the many sorts of FX traders that operate in the world's biggest market.

THE SIX DIFFERENT FOREX TRADER TYPES

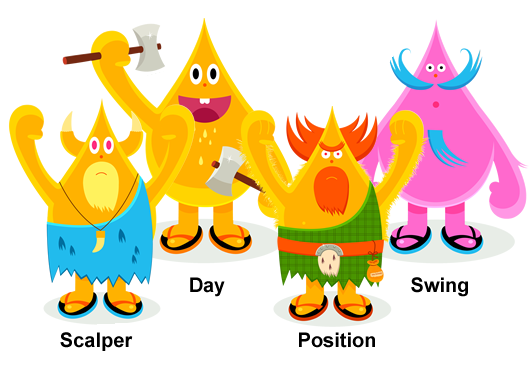

Forex traders are often classified into one of six trading types: scalpers, day traders, swing traders, position traders, algorithmic traders, and event-driven traders. Scalpers are those who trade on the spot market while swing traders are those who trade on the futures market. Take our DNA FX Quiz to find out which form of DNA is best compatible with your personality! Also, have a look at the different categories of people listed below to learn about the character qualities that are most appropriate for each.

1. Scalper

Scalpers are short-term traders that concentrate on holding positions for short periods of time, such as a few seconds to a few minutes, rather than for longer periods of time. Forex scalping tactics include trading often throughout the day with the goal of generating tiny profits during the busiest (most liquid) periods of the market's trading day.

Scalpers are used to living life in the fast lane. Being constantly confronted with fresh information and responding to fast market changes requires you to be alert, instinctive, and quick-witted – but also stoic when under pressure – qualities that are excellent for this position.

2. Day Trader

Day traders are also known for making several deals inside a single day's span. While their routine may not be as fast-paced as a scalper's, day traders will follow a similar pattern in that they will terminate all positions before the conclusion of the trading day in order to avoid holding any holdings over the weekend. In other words, unfavorable news that might impact prices before the market begins or after it closes will have no effect on the transactions taking place.

A good day trader must be able to react quickly to price fluctuations and be aware of the tactics that are essential to this form of trading, such as fading the gap, in order to be successful in this business.

The chart below is an example of a five-minute chart that is often utilized by scalpers and day traders, and it shows typical entry and exit positions for day trading. These points are based on Relative Strength Index (RSI) signals, with the oversold and overbought levels marked on the chart to indicate where the market is currently trading.

3. Swing Trader

Swing traders stay onto their deals for a period of time more than a single day, and sometimes for many weeks. Swing traders would often emphasize technical research over fundamental analysis over a short period, while they should be alert to news developments that may cause volatility in the market.

This trader type is less frenzied than scalpers and day traders, thus high attentiveness is not required as much as it is for scalpers and day traders. However, when it comes to chart analysis, you will still need a keen eye for detail. Learn more about how to recognize and trade market swings in this article.

4. Position Trader

Position traders hold their transactions for extended periods of time, ranging from a few weeks to many years at a time. Position traders, who have the longest holding duration of any trading technique, are less concerned with an asset's short-term price movements and more concerned, naturally, with the asset's performance over longer periods.

As a forex position trader, you will need to be patient since your money will often be locked up for extended periods of time. When dealing with longer-term transactions, a full understanding of basic issues is advantageous; thus, strong analytical abilities will be of great use to you.

This example of a daily chart, which is commonly employed by position traders, depicts a long position and an exit about a month later, both based on RSI indications marked on the chart, as seen in the previous example below. In addition to trading on a daily basis, position traders may often scale down to lower durations to identify patterns.

5. Algorithmic Trader

Algorithmic traders depend on computer programs to conduct transactions on their behalf at the best available pricing, according to their preferences. To create their own programs, traders might employ established instructions, often known as high-frequency trading algorithms. Alternatively, traders can buy pre-made goods.

This sort of trading is suited to those who are acquainted with technology and who want to use it to their forex trading profession as well.

The technical charts will be of particular interest to algorithmic traders, given the nature of the algorithms.

6. Event-driven Trader

Traders who are motivated by events rely on fundamental analysis rather than technical charts to influence their judgments. They'll look for opportunities to profit on spikes in data resulting from political or economic events, such as Non-Farm Payroll data, the Gross Domestic Product, employment numbers, and elections.

This form of trading will appeal to someone who enjoys keeping up with current events across the globe and who is knowledgeable about how events might affect the markets. You will be competent at digesting new information and making predictions about how global and local events will play out. You will be inquisitive, inquiring, and forward-thinking.

The chart below illustrates how the Non-Farm Payroll report might provide an opportunity for an event-driven trader who employs the usual approach of initiating long when the price breaks above the trendline of a retreat after the release of the report.

DIFFERENT TYPES OF FOREX TRADER SUMMARIZED

|

FOREX TRADER TYPE |

TIME IN TRADE |

PERSONALITY TRAITS |

|

Scalper & Day Trader |

1 min-1 day |

Observant, Instinctive, Quick Witted |

|

Swing Trader |

2-6 days |

Calm, Selective, Focused |

|

Position Trader |

Weeks-months |

Patient, Systematic, Strategic |

|

Algorithmic Trader |

All timeframes |

Tech-savvy, Technical, Mathematical |

|

Event-driven Trader |

All timeframes |

Inquisitive, Analytical, Forward-Thinking |

CAN YOU CHANGE YOUR FOREX TRADING STYLE?

No forex trading style need be static and there is every probability yours might evolve. You may be a scalper stressed by short-term price actionand wanting the leisure time afforded in position trading. Or, you may be a technical swing trader who wants to understand more about the fundamentals of the events-driven method.

Whatever your style or aims, there is always a method to learn and improve, and test your talent on the markets in new ways.

FURTHER READING TO DECODE YOUR TRADER TYPE

For more information on identifying your ideal trading style, as well as how to manage the ups and downs of forex trading, take a look at the following:

- Top forex trading strategies every trader should know

- How to keep a forex trading journal and set trading goals

- Need a forex trading refresher? Download our New to Forex guide.