FX Update: Two-way action in JPY, Fed still behind the market.

Summary: Overnight, conflicting statements from the Bank of Japan, which indicated at no change in its policy position while noting currency volatility, were combined with more forceful comments from the Ministry of Finance to arrest the yen's precipitous decline. Elsewhere, financial conditions, at least in terms of market volatility, have continued to improve and may be approaching a tipping point, according to some analysts. Will this elicit a reaction from the Federal Reserve?

FX Trading focus: Some two-way action in JPY after BoJ comments. End of quarter ahead.

After a terrible decline in the Japanese yen over the previous two weeks or so, we finally witnessed some two-way movement in the JPY cross market overnight. Governor Kuroda of the Bank of Japan was out speaking, and he made a muddled collection of remarks. Compared to the preliminary February CPI figures for the whole country, the preliminary March Tokyo CPI statistics show a similar pattern: a new high in the headline index, while core inflation remains around the lowest levels in a decade (-0.4 percent year-on-year versus -0.5 percent expected and -0.6 percent in Feb.). There were no indications of Kuroda backing down from the Bank of Japan's policy position, and he even went to the bother of explaining that a lower Japanese currency is still beneficial to the Japanese economy, saying that inflation, rather than the yen, would be the trigger for a shift in policy in the future. And he believes that cost-push inflation, such as is presently occurring, will not result in stable inflation of 2 percent over time, but would instead undermine the economy by reducing disposable family incomes and corporate margins, which will in turn affect the economy. Nonetheless, the Governor stated that the Bank of Japan is closely monitoring the currency, whatever that means, while the more credible Ministry of Finance (which has been at the forefront of actual currency interventions in the past, some of which have been monumental) stated overnight that disorderly foreign exchange movements are not desirable.

Albert Edwards, a strategist at Société Générale, published a piece yesterday stating that the yen faces a high risk of further deterioration if a carry trade develops as Japanese traders pile into foreign currencies and bonds while the Bank of Japan keeps interest rates at a low level, as the Bank of Japan has done. This dynamic is unavoidable as long as the Bank of Japan maintains its 0.25 percent restriction on 10-year JGB rates (which fell to 0.24 percent overnight) and yields continue to increase abroad. The expanding disparity between the real-effective value of the yen, which is presently at a modern low, and the very strong Chinese yuan, which Edwards points out, indicates that there is rising pressure on the yen. Chinese authorities had the luxury of "devaluing" the currency the last time, both because they wished to avoid trailing the US dollar's more accelerated climb and because that same increase had devastated global commodity prices, notably oil, at the time. That does not seem to be the present background — but the scenario appears to be very stressful, regardless of the setting.

Chart: USDJPY

Despite the fact that we have seen a general extension higher in global risk sentiment and easing financial conditions coming into today, both of these factors are working against carry traders. The latest move in US 10-year yields yesterday outran the latest move in the USDJPY yesterday, which peaked very late in the day on Tuesday in the US before trading sideways. The Bank of Japan's and the Japanese Ministry of Finance's statements overnight provided the market with its first taste of two-way volatility. And, as we discussed on this morning's Saxo Market Call podcast, we are barreling toward quarter-end (and the end of the Japanese financial year) next Thursday after a particularly brutal quarter for bonds, which could result in some mechanical portfolio rebalancing that provides some support for bonds and, therefore, possibly for the yen in the near term. In contrast, if bond yields continue to rise, whether now or after a quarter-end dip, the cycle top in JPY crosses may be far ahead, and possibly dramatically so, if an important cohort of traders piles into a new carry trade investment theme (as discussed above), even if it is unsustainable in the long run. The next significant milestone is the almost 20-year high that is just short of 126.00.

On the SMC podcast, we also discussed the still-easy financial conditions in the United States, as equities race toward the last major resistance before reaching new all-time highs, despite the fact that initial jobless claims were nearly the lowest in US history yesterday, indicating a very tight labor market in the United States. The margin between one high yield credit indicator and US treasury rates has narrowed by 60 basis points in the previous 10 days, according to the data I watch. The early PMIs for the United States released yesterday were firmly positive, indicating that there would be no dramatic downturn for the time being. Additional economic data from the United States will be released next week, including the employment and earnings statistics for March, which will be released on Friday.

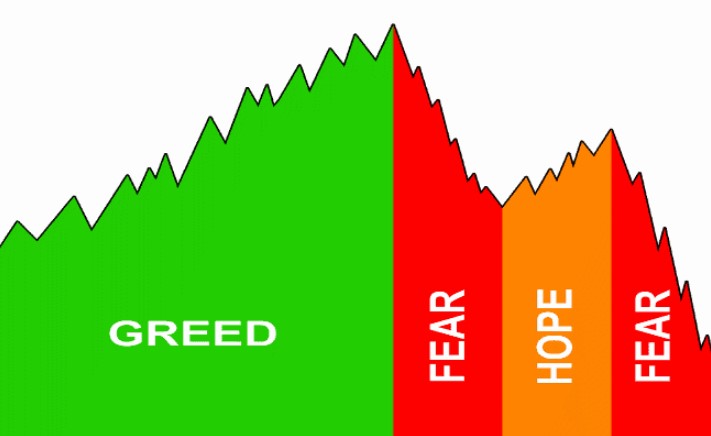

If credit spreads continue to narrow and stocks continue to rise, the wait until the May 4 FOMC meeting will seem particularly lengthy. Do you think the Federal Reserve will have to come out and one-up themselves once again – maybe with a signal of a super-sized hike in May or even a hike between meetings? Despite the fact that it is not Jay Powell's style, the Federal Reserve is continuing to pursue the market and inflation from behind. A Citi analyst has boosted his own forecasts, predicting that the Federal Reserve would raise interest rates by 50 basis points at each of the next four sessions. Folks, keep your caps on your heads.

The Russian ruble is down around 15% versus the euro since Russia invaded Ukraine, an incredible fact given the scale of sanctions against Russia, especially its central bank. But a recent Bloomberg article goes through the degree to which Russian can skirt sanctions, especially on the export side. The much more difficult task is the import side, as so many imports Russia needs are from sanctioning countries, but ironically this could help drive a widening current account surplus that helps support the ruble. Another article from Bloomberg discusses European concerns that China could aid Russia with high-tech components. The potential for knock-on and widening geopolitical conflicts stemming from the war in Ukraine and perceived “side-taking” remains a powerful risk. A phone summit with the EU commission’s Von der Leyen and Charles Michel and China’s Xi Jinping is set for next Friday.

Table: FX Board of G10 and CNH trend evolution and strength.

Not much new here, but the CHF is not following the JPY plot in any way, shape or form. Commodity strength clearly in evidence.

Table: FX Board Trend Scoreboard for individual pairs.

Note hefty ATR readings (top decile volatility for last 1000 trading days) all over the shop, with one major exception…..USDCNH. The tension builds….

Upcoming Economic Calendar Highlights (all times GMT)

- 1400 – US Fed’s Williams (voter) to speak

- 1400 – US March Final University of Michigan Sentiment

- 1530 – US Fed’s Barkin (non-voter) to speak

- 1645 – Canada Bank of Canada’s Kozicki to speak