Trading The Morning and Evening Star Candlestick Patterns

More than 100 designs based on Japanese candlesticks are known to exist, with the majority of them being geometric. In order to categorize them, we split them into several groups such as bullish and bearish forms, reversal and continuation formations, as well as basic and complicated patterns.

Both the morning and evening star patterns are regarded to be more intricate formations, mostly because they are based on three consecutive candles, as opposed to the daytime pattern. As a result, they are more uncommon than other patterns, particularly the single-candle formations, and as a result, they are more valuable.

Structures

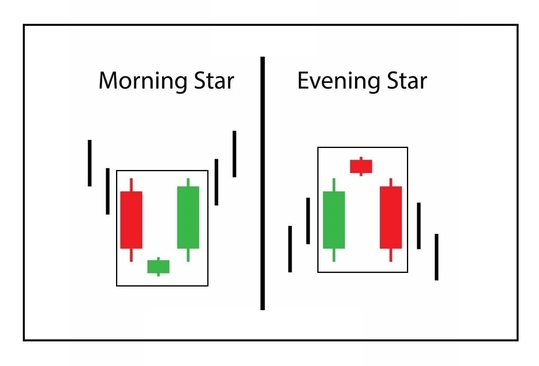

The morning star is a bullish reversal pattern that appears at the bottom of a downtrend and signals the beginning of a new uptrend. As with other candlestick patterns, it simply indicates the possibility of a reversal, which should preferably be verified by other indicators before being taken seriously.

Four elements to consider for a morning star formation

- Because a morning star is a bullish reversal pattern, a downtrend must be present in order for it to occur.

- The first candle should be a bearish candle, ideally one that is larger in duration than the second.

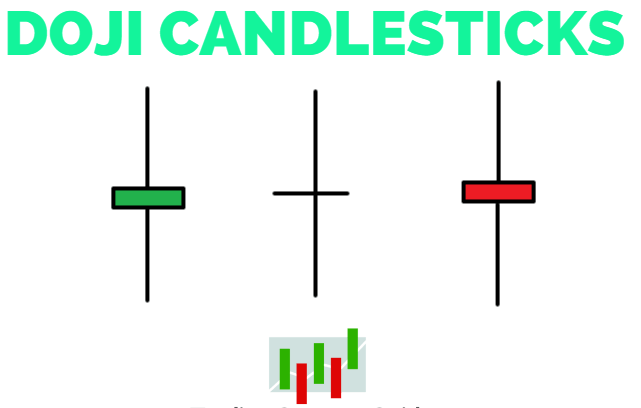

- As the bulls and bears begin to level out throughout the course of the session, the second candle should be undecided.

- As a result of the third candle being very bullish, the reversal should be basically confirmed at this point.

Despite the fact that some experts like a gap down, it is highly unusual to see gaps in the forex market. As a result, many experts believe that a true morning star pattern may be identified as long as these four criteria are satisfied.

It is critical to notice that the second candle is the most significant of the three. It may be either bearish or bullish depending on whether the emphasis is on indecision and an unknown result as to which of two opposing factions will emerge victorious.

The Evening Star formation

However, the evening star, which has the same structure as the morning star, is also a pattern that reverses. In contrast to the morning star, the evening star appears at the peak of an uptrend and indicates the possibility of a shift in the market direction.

All four criteria that are present in the morning star structure are also present in this structure. When an uptrend is nearing its conclusion, the first candle should be lengthy and bullish, the second should be at the top and show indecision (green or red), and the third and final candle signifies that a reversal is underway, as the buyers have lost control over the price movement.

Trading the morning star candlestick pattern

As previously stated, the occurrence of a morning star pattern is not as common as the occurrence of a single-candle configuration in the sky. They are more difficult to detect, apart from the fact that you must literally meet all four prerequisites before you can confirm their existence.

Here, we have the daily chart of the Australian dollar vs the US dollar. The price had been steadily declining until it reached the point when it established a new short-term bottom. The candle that precedes this one is a lengthy bearish candle, which indicates a substantial fall in the market.

Sellers fail, however, to force a close around the session low, resulting in a doji candle that reflects the lack of consensus among buyers and sellers on the direction of the market. The following candle is a long bullish candle, which makes the morning star pattern on the next candle after that. As a result, we can now practically be assured that the bullish reversal is set to begin taking effect.