The Engulfing Candle Day-Trading Strategy

When it comes to trading, trading with the trend is one of the most helpful things a trader can learn. Stocks, currencies, and futures may all benefit from using an engulfing candle day-trading method, which allows you to enter trending movements just as the momentum is gathering up speed.

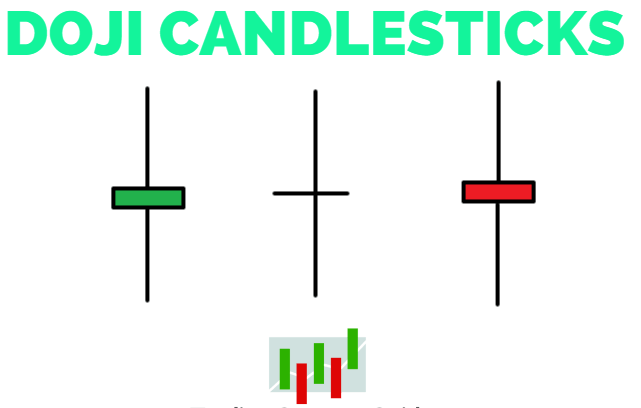

The "true bodies" of candlesticks are the broad regions of the candlesticks in a candlestick price chart. In a down or bearish candle, the top of the candle represents the initial price, and the bottom represents the closing price for the time under consideration. Black or crimson is often the color of the actual body of a down candle. When a candle is up or bullish, the top of the candle represents the closing price, and the bottom represents the beginning price. The actual body of an up candle is often white or green in color. The high and low prices for the time may be denoted by thin lines that resemble candle wicks and extend beyond the actual body of the candle.

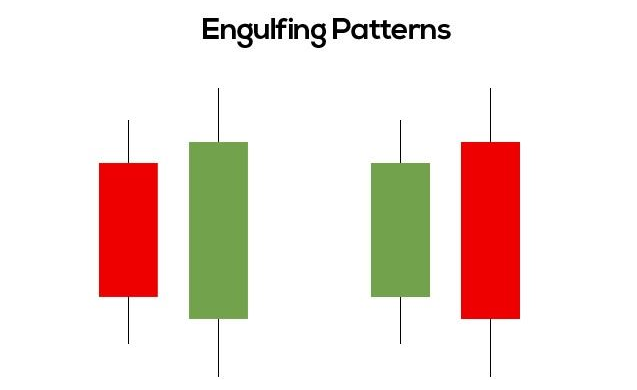

This kind of candlestick formation happens when the actual body of a down candle entirely encompasses the real body of a preceding up candle. A bullish engulfing candle is formed when the actual body of an up candle totally engulfs the real body of the preceding down candle in the same time frame.

Engulfing candles signal a significant change in direction, and when paired with the observation of the price-trending direction that preceded it, this shift presents a chance for a trading strategy to be implemented.

Key Takeaways

- The first step in applying the engulfing candle day-trading strategy is to determine the dominant trend direction, and thus the direction you will trade-in.

- Once the trend is established, wait for a pullback. If there is no trend, or it is unclear, don't utilize this strategy.

- With the trend isolated and a pullback occurring, wait for the engulfing candle strategy trade signal.

- A rule of thumb is to make sure your winners are at least one-and-one-half times as big as your losers; two times bigger is even better.

Isolate the Trend

The first stage in implementing the engulfing candle day-trading method is to identify the main trend direction, which is then used to establish the direction in which you will place your trade.

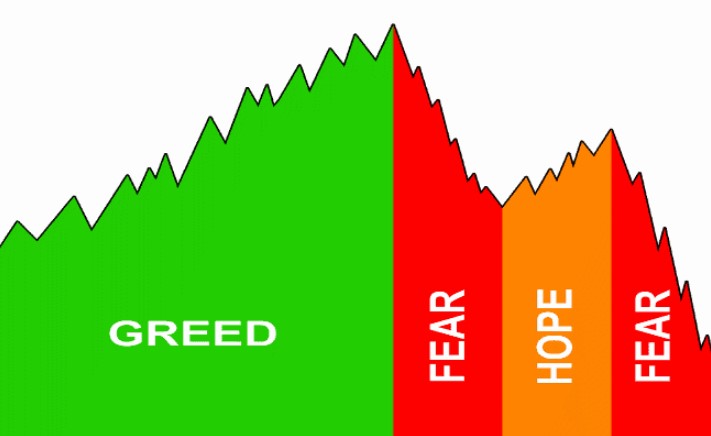

When it comes to prices, an uptrend is defined by higher swinging highs and lower swinging lows. Prices move in waves, moving forward, then pulling back, and then moving forward again. In an uptrend, the advancing waves are larger than the reversing waves, resulting in overall progress being made in the upward direction. Only long positions should be taken during an upswing, with the objective of selling later at a higher price if the market continues to rise in value.

A downtrend in the price of a security is defined by lower-swinging lows and lower-swinging highs. In a downtrend, the declining waves are larger than the upward pullbacks, resulting in overall progress being made downward. You should avoid taking long positions during a downtrend, instead selling a borrowed asset with the intention of buying it back later at a reduced price.

Watch for an Upward or Downward Pullback

Once a trend has been established, it is necessary to wait for a reversal. If there is no trend, or if the trend is uncertain, this method should not be used.

Waiting for a downturn ensures that you will get favorable pricing for the following wave of the trend, whenever and wherever it manifests itself.

If the trend is downward, keep an eye out for a pullback to the upside. The retreat should not recover beyond the high of the previous pullback, since this would be in violation of the principles of a downward trend.

If the trend is upward, keep an eye out for a downward reversal. If the pullback falls below the low of the previous pullback, this is considered a violation of the principles of an uptrend and should be avoided.

In order to be considered a pullback, there should be at least two price moves, demonstrating that the price has genuinely corrected. Pullbacks may travel in the opposite direction of the trend or they may simply move sideways in the same direction.

Entering the Trade

Wait for the engulfing candle strategy trade signal to appear after the trend has been isolated and a retreat has occurred.

During a downtrend, wait until a down candle completely engulfs an up candle before entering the market. In real time, you should enter a short trade as soon as the closing price of the down candle falls below the starting price (the bottom of the true body) of the up candle. There is no need to wait until the candle is completely consumed.

During an upswing, wait until an up candle completely engulfs a down candle before using the engulfing candle approach. Enter a long trade as soon as the opening price (the top of the actual body) of the up candle crosses over the opening price (the top of the real body) of the down candle in real time.

In order to protect your profits while trading using the engulfing candle approach, set a stop-loss order above the most recent high for short positions and below the most recent low for long positions.

Exiting the Trade

A bullish engulfing candle that appears after a downturn in an overall trend is intended to entice you into a trade just as the following wave of the trend is anticipated to begin to manifest itself. (This is not always the case.) Trends might last for a lengthy period of time or they can go away fast. This method does not have a specified exit, as a result of this.

Make sure your winners are at least one-and-one-half times as large as your losers, if not two times as large as your losers. As a result, you should estimate the distance between your entry point and the location where you put your stop-loss. If the price is 30 cents, for example, you are taking a risk. If you want to make a profit, your goal price should be at least one-and-one-half times higher, or 45 cents. As a result, you should hold the trade for at least a 45-cent profit to make up for the risk you've made.

If the trend seems to be reversing, either via the formation of higher highs and higher lows (not necessarily in that sequence) during a downtrend and short trade or by the formation of lower highs and lower lows during an uptrend and long trade, the trade should be closed out.

Cautionary Notes

You should be "fast on the draw" if you're trading on a short time period, such as one minute or, say, a 30-tick chart. ) A tick chart is a bar chart that displays the number of transactions rather than the time. You should decide where you will set your stop loss and then rapidly calculate what your minimum goal price for the trade is if an engulfing candle signal seems to be impending.

Because engulfing patterns will not appear with every downturn, there will be lost chances in the future. Consider enabling numerous candles to form an enveloping pattern to help prevent this from happening. When a pullback in an uptrend occurs and it takes two up candles to engulf the preceding down candle, this is considered a solid indicator that momentum is shifting back in the current direction.

The occurrence of an engulfing candle strategy indicator does not necessarily imply that the trend will restart. It is for this reason that a stop-loss is required.