How to Use Bullish and Bearish Harami Candles to Find Trend Reversals

Harami candle Harami candle is an Japanese candlestick pattern that could indicate trend reversals, and provide cryptocurrency traders with a favorable trading setup with a high risk-to-reward ratio. The pattern is created by using two candles: a high candle that is followed by a much smaller candle.

Harami patterns are available at any time. Trading them is easy when you're able to recognize the patterns.

What is Harami Candlestick Pattern? Harami Candlestick Pattern?

The Harami candlestick pattern is a reversed pattern comprised from two candle. The first candle is an enormous candle, which is continuing an existing trend. The second candle is considerably shorterand of a different color, which indicates a reverse of the current trend. The body of the first candle must completely cover the body of the second candle.

The Harami is one of the Japanese candlestick pattern that's very popular with cryptocurrency traders. It's easy to recognize and provides traders with a small risk-to-reward ratio. In the end, the Harami pattern can provide an excellent risk-to-reward ratio when trading it.

"Harami" is an Japanese word which means "pregnant." This image helps understand exactly what Harami chart patterns suggest. Similar to a woman who gives birth to a newborn baby and the Harami pattern can be said to birth an exciting new trend. Some experts might suggest that the shape looks like a pregnant woman as well.

There are two kinds of Harami patterns which are bearish and bullish.

The Interpretation of this pattern Bearish Harami Candlestick Pattern

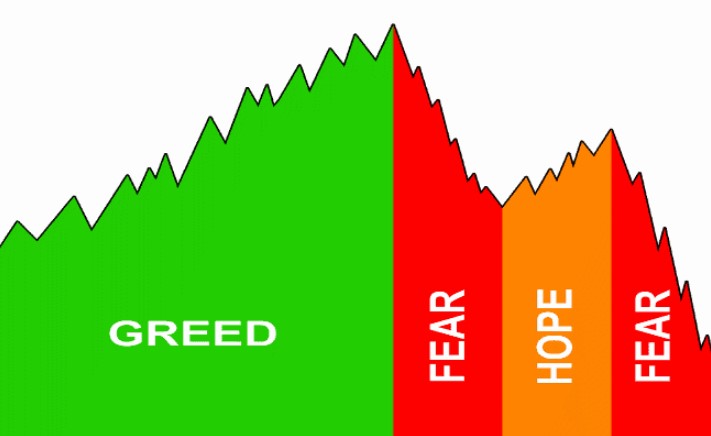

A bearish Harami occurs near the top of an upward trend. The pattern begins with a huge green candle that is bullish which is then an even smaller red or bearish candle.

The most important aspect of this bullish Harami style is the requirement that the subsequent candle needs to move lower to indicate that the previous uptrend has been weakened. Within the crypto market trading is constant all day, seven days a week. Thus, it's rare to observe a dip upwards or downwards in the crypto.

In this regard, watch for the second candle to begin to burn and then sell it off. Its body must to completely cover that of the subsequent completely. This is the key for the Harami pattern, since the prices are so weak that they cannot revert back to a bullish momentum and return to the previous high. This signals that there is a possibility of shift.

The Candlestick Pattern of the Bullish Harami

A bullish Harami candle pattern the reverse of that of the bearish Harami and occurs at the bottom of an uptrend. The first candle in the pattern appears to be a huge bullish (red) candle. Then, prices rise in the following candle, which is a much smaller and a the green candle is bullish.

In the world of cryptocurrency the chances are that there won't be to be any gap higher. Therefore, the bearish trend will begin shortly after the end to the candle that was first closed. It's crucial that both candles, which is the green candle that is bullish to be completely covered into the body initial red candle.

The bullish Harami suggests it is moving from downwards to upwards.

What's an Harami Candle Look Like?

Harami Harami is a two-candlestick design. One candlestick stands tall. Second candlesticks are considerably smaller. Its body has to be contained or enclosed inside the body of the first candle. Ideally, you'll want to observe the second candle as smaller than the original candle.

This is the reason why the picture of a woman who is pregnant makes sense: she's one of the initial (tall) candle and the baby the second candle that is smaller inside the first.

A significant distinction is that the second candle must gap from the other direction to the initial candle. In the crypto market, gaps are very rare and the patterns might appear slightly different.

As an example, we can see an uptrending bullish Harami emerge on the 4-hour chart of LINK. On this chart LINK appears to be in a downward trend that is corrected lower by around 30 percent. After that, a bigger-than-normal bearish candle appears which is followed by a tiny green candle. The two candles create an upward-looking Harami. After that an uptrend begins to kick off and LINK increases by 40%.

The process of identifying Bullish as well as Bearish Harami in a trading Chart

After you've become familiar with the form and structure of the Harami it's vital to know where you can find this design in the market for cryptocurrency.

The bullish Harami pattern are the start to new bull trending patterns similar to what we can observe in the Ethereum chart above. So, you can only spot patterns in the course of an uptrend. After a string of lower lows and higher highs and lower lows, the bullish Harami pattern begins with a large bearish candle. This suggests that the downtrend is accelerating and likely to capitulate.

When the candle is finished the candle, a rapid rally starts but then stalls. The sellers have run out of fuel, however the buyers haven't arrived yet. This cuts the second candle of the pattern that is smaller, and is enclosed by the body of the first candle.

This pattern is confirmed as the market continues to rise while remaining above the low of recent.

It's the opposite for an inverse bearish Harami pattern.

A bearish Harami is the beginning of the beginning of a new bear trend. It is therefore seen as the final phase of an upward trend. As the trend continues to rise like above XRPUSD chart above the Harami begins with a huge green candle that can be seen as the result of a blow-off from an older trend. The trend is unable to expand further and the price is beginning to drop since the second candle's highest is lower than the closing of the previous candle.

There is no significant movement on the downwards, and the 2nd candle's body is completely absorbed by the one candle. This pattern of price suggests that the market is in such a weak state that it is unable to rally to its previous highs.

If there are no buyers from the beginning and the price continues to fall in a downward trend, kicking off a new one.

Harami Cross vs. Doji Candle

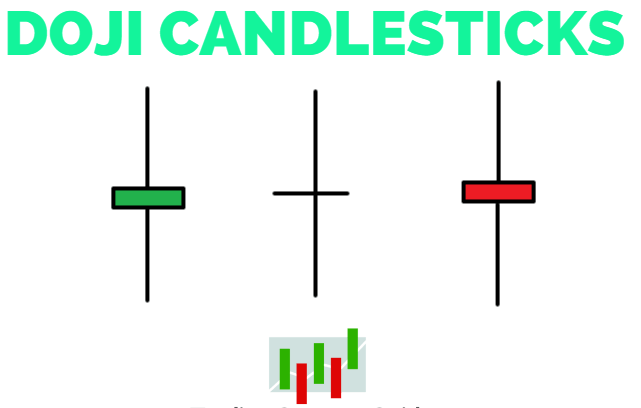

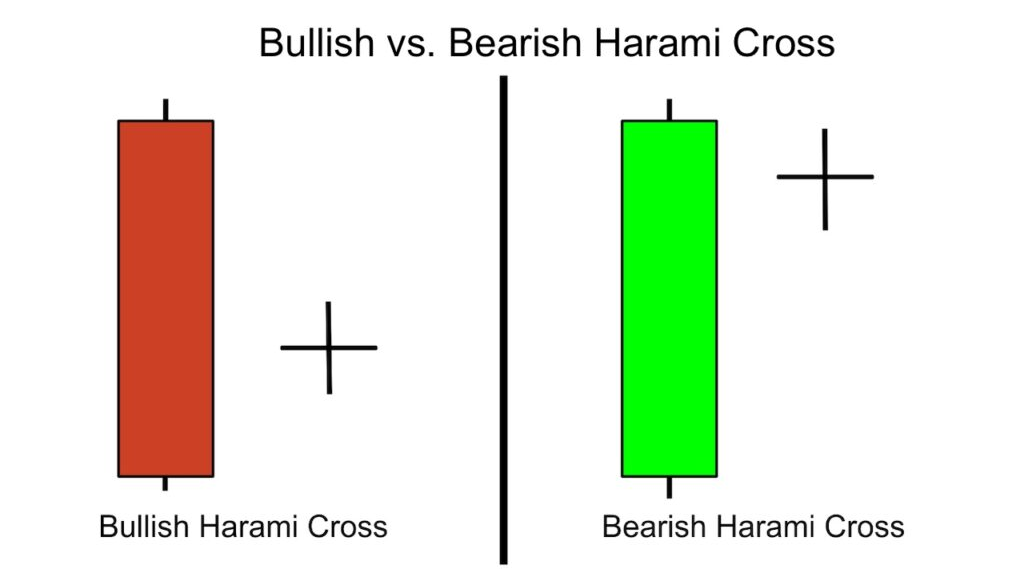

Certain Japanese candlestick patterns are similar and can be difficult to differentiate from each other. For instance it is the Harami Cross candle is a specific kind that is a specific type of Harami pattern. It shares some similarities with the doji pattern, however there are some differences both.

The first thing to note is that Harami Cross is the first thing to be mentioned. Harami Cross is a combination of the Harami pattern and an doji with a star.

The second candle in Harami Cross. The second candle of Harami Cross is a star Doji, which resembles the sign of a plus. The same principles apply that the plus symbol must be enclosed in its body. candle that was the first.

The doji candlestick pattern bears certain similarities with similar patterns to the Harami Cross. The most obvious similarities is that the star doji pattern is one of five types of patterns for doji. A particular type of doji is being placed into one of the candles in the Harami Cross.

But it's true that it is important to note that the doji patterns are a single-candlestick pattern, whereas it is the Harami Cross is a two-candle pattern. The doji pattern is not trending. The doji design suggests uncertainty We aren't sure what the next trend is going to be.

However on the other hand, Harami Cross Harami Cross is at the center of a trend reversal. Combining the star doji and the candlestick that is large of the Harami creates a pattern that indicates the trend could be about to reverse.

How to trade with the Harami Candlestick

The advantages from trading on the Harami pattern are the strong signals it creates. They are easy to identify, and they could provide high risk-to-reward opportunities. Below, you'll find a step-by step method to identify and trade both kinds of Harami patterns.

Trading using Bullish Harami Candle

In the beginning in 2021 Bitcoin went on upward trend. There were short dips that served as consolidation zones for the next bull run.

One consolidation zone was concluded with an upward-looking Harami pattern. Let's look at this pattern more carefully.

At the beginning of Jan. 2021 Bitcoin was beginning to consolidate the gains it had made in recent months and began to trend lower in the course of a correction. A downward trend is the first step to create an environment that is ripe for the bullish Harami (1).

January 21, which is the most lower day ever for Bitcoin is a sign that traders are resigning and that a bottom is likely to appear. The large red candle is the first of two candles of Harami pattern (2). Harami design (2).

The next day is a day that sees Bitcoin slightly lower, but the day ended at a higher cost. The second candle is completely engulfed in the body of previous candle (3). This is a way to create a market for bullish opportunities.

The trading setup is simple. The long entry takes place right above the second candle's high. In this scenario the long entry is expected to be close to the $33,000 mark (3).

The stop loss must be set to be just beneath the Harami low level. In this instance there was a new swing low that was just below the similar price range. Thus, it is wise to place your limit loss just below the lows that are close to the $27,480 mark (4).

We then find what is the difference between where we enter and when the stop loss occurs. In this instance we have a difference of $6,320. It is our goal to double the distance, and it will be $12,640.

Add the newly doubled amount to the initial price to calculate the take profit level. $33,800 plus $12,640 gives an estimated take-profit that is $46.440 (5).

This guarantees a risk-to-reward ratio.

After a few candles after which an entry for long-term trades in Bitcoin triggers. The trader then waits to see if the price will reach the desired level or limit to met. The prices are close, but they never reach the stop loss threshold until they eventually hit the target.

Trading using the Bearish Harami

In using Bitcoin's daily chart for an example, in the month of March 2021, the largest cryptocurrency was rising to new records. This surge had grown robust and extended. The chart below shows the signs of a top begin to appear when a huge green candle begins to rise. The green candle needs to be bigger than other candles in the chart at that point.

Bitcoin is currently in a rally and is in a distinct upward trend (I). As the rally extends into new highs on March 13, depicted by the long, yellow candlestick (first candle for Harami) which indicates that the purchasing pressure is high within the current trend.

The first candle is an upward correction which ends around halfway through the initial candle. The red bearish candle is the second candle in Harami pattern (III). Harami design (III).

The trader is now waiting for the lower end in the candle's second to break to indicate an entry bearish in the market (IV). Stop loss set close to the Harami pattern's highest point (V). The objective is at about twice the distance between the point of entry to where the stop loss is (VI).

The price of Bitcoin reaches its target within a few weeks, and is not stopped. This is an excellent illustration of how the pattern can create a narrow risk range, and also provide high risk-to-reward trading.

Can Harami Patterns Can it be Guaranteed to be Accurate?

Remember the fact that there aren't all transactions result in your favor. It's not realistic to think that all of your trades to yield profits. Similar logic could be applied in this Harami pattern.

Although it is true that the Harami pattern is simple to recognize, and is able to result in winning trades with a high risk-to-reward, it doesn't mean every trade is a sure winner. That's why we suggest that you use a ratio of risk to reward of 1:2 in the trading strategies above.

This way, you'll be wrong less than half the time, but give yourself the chance to increase your bank account because the winning trades you make are more than the losses.

The Bottom Line

The majority of crypto traders follow Harami candles in patterns. Harami patterns are common in crypto markets. Harami pattern is often seen in crypto exchanges and the trading process it is simple.

The traders appreciate the narrow risk and reward possibility that the Harami pattern has to offer. Like any other analysis tool it's not certain to produce profitable trades. To get the most effective outcomes, you must seek out the Harami pattern in its context within the proper trend, and also to integrate it alongside other tools to trade.