How to Trade Shooting Star Candlestick Patterns

TRADING WITH SHOOTING STAR CANDLESTICKS: MAIN TALKING POINTS

Japanese candlesticks are a common charting method employed by many traders, and the shooting star candle is no exception. This article will explore the shooting star reversal pattern in depth and how to utilize it to trade forex.

- What is a shooting star candlestick pattern?

- Advantages of using the shooting star in technical analysis

- Trading the shooting star pattern

- Further reading on how to trade with Candlesticks

WHAT IS A SHOOTING STAR CANDLESTICK PATTERN?

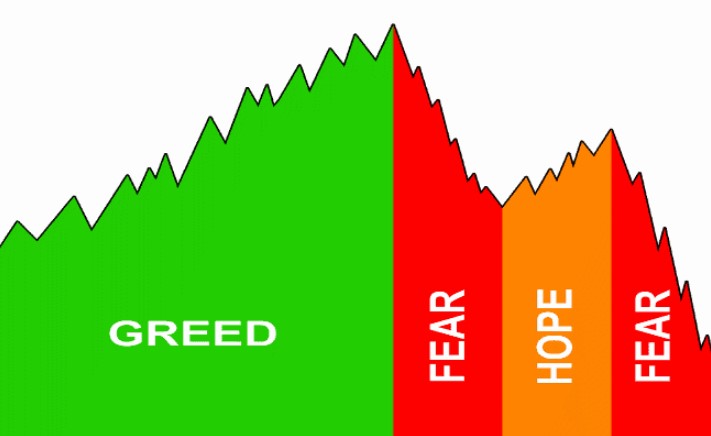

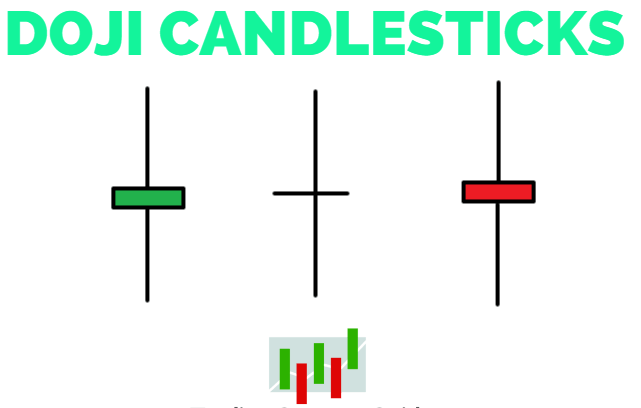

One candle makes up a shooting star formation, which is a bearish reversal pattern that occurs just once in a chart's history. It is generated when the price is pushed higher and then promptly rejected lower, resulting in a lengthy wick to the upside being left behind. In order to make a shooting star candle, the wick should be at least half the overall length of the candle (see illustration below).

In addition, the closing price should be close to the bottom of the candle as a whole. As you can see, this results in an overall negative structure since prices were unable to maintain their previous highs throughout the trading session.

Inverted Hammer patterns have a structure that is identical to the Hammer pattern, however they are associated with bullish reversal signals, rather than bearish reversal signals, as opposed to the Hammer pattern. This candlestick pattern is often seen near the bottom of a downtrend, at a support level, or during a retreat.

A common issue concerns the distinction between a shooting star formation on a forex pair and a similar pattern on a stock or a commodities price. In the financial markets, there is no distinction between the numerous forms of financial markets. Regardless of the equipment, a shooting star candlestick pattern will provide the same signal or signal combination.

ADVANTAGES OF USING THE SHOOTING STAR IN TECHNICAL ANALYSIS

Because of its simplicity, the shooting star pattern is an excellent tool for technical traders who are just starting out. It is simple to identify a probable shooting star candlestick pattern if traders follow the pattern description provided above.

The candle pattern will sometimes be incorrect on its own, although this is rare. However, if the pattern comes around a resistance level or a trend line, the shooting star might serve as further confirmation of the new negative outlook. This is due to the fact that a single candle does not have a significant role in the overall trend or movement of the market.

When using this candlestick pattern, it is critical to consider risk management strategies. This offers the trader with a'safety net' in the event that the market moves in a bad direction.

The following are some of the advantages of the Shooting Star candlestick pattern:

- Easy to identify

- Reasonably reliable if all criteria are met

- Suitable for but not limited to novice traders

Limitations of the Shooting Star candlestick pattern:

- Shooting Star candle does not dependably define a short trade

- Confirmation is needed – further technical/fundamental justification

TRADING THE SHOOTING STAR  PATTERN

EUR/USD Shooting Star Candlestick Pattern:

Trading this reversal pattern is rather straightforward. First and foremost, the implication is for lower prices, which is why we want to seek for opportunities to short. Because the prices were previously rejected at the shooting star's peak, we will attempt to place the stop loss at the most recent swing high (red horizontal line on the chart).

A trader might simply join on the open of the following candle, or, if the trader wanted to be more cautious and acquire a better risk-to-reward ratio, he or she may trade the retest of the previous candle's high (black dashed line). When the wick is longer than typical, it is more likely that a retest will be required.

Prices will often retrace upward a section of the lengthy wick and then drop back down. Trading strategies that take this into consideration include waiting until the middle of the wick rather than entering soon after the shooting star candle develops. This indicates that the trader is starting a short position at a higher price and with a tighter stop loss, hence minimizing risk. In either case, the stop loss will stay constant, irrespective of the entrance strategy.

When it comes to profit goals (the blue line), DailyFX recommends taking profits at least double the distance between the stop loss and the profit objective. For example, if the stop loss is 90 pips away from the beginning level, then search for a profit possibility of at least 180 pips on the trade. This is widely used to refer to a risk-to-reward ratio of 1:2, which corresponds to the findings of the Traits of Successful Traders study.

FURTHER READING ON HOW TO TRADE WITH CANDLESTICKS

- For more on candlestick patterns, refer to our article on the Top 10 Candlestick Patterns to trade the markets.

- Supplement your understanding of forex candlesticks with one of our free  forex trading guides.

- Further your knowledge on candlesticks with a foundational piece on forex candlesticks.