How to Combine Different Types of Forex Analysis

To analyze the foreign exchange market in order to uncover successful trading opportunities, there are several tools accessible to traders today. Furthermore, it has been shown that integrating multiple methodologies is more helpful in terms of creating profits.

The three main types of analysis are:

- Fundamental analysis

- Technical analysis

- Sentiment analysis

It is more convenient for some traders to focus on a particular form of analysis since this makes it simpler to grasp a certain sector of the forex market properly. Taking a mixed strategy, on the other hand, removes many of the disadvantages of focusing on a single technique and boosts the likelihood of uncovering lucrative transactions.

To be really honest, all three methodologies are required in order to conduct a thorough market study of any kind. In the same way that a three-legged stool requires all three legs to be stable, forex trading need all three forms of analysis to be successful in order to be profitable.

If you concentrate just on one strategy while ignoring the others, your analysis may be inadequate and may result in losses. A weakness in one kind of analysis approach may be readily overcome by considering the strengths of another type of analysis technique.

So, how can you bring the three sorts of forex analysis together in one place?

Let's start by discussing each of the potential ways one after another.

Fundamental Analysis

This form of study is concerned with the numerous economic variables that have an impact on the value of currencies. Inflation rates, interest rates, political difficulties, the unemployment rate, and the Gross Domestic Product are just a few of the economic basics to consider.

Fundamentalists are traders who use fundamental research to locate trading opportunities. They think that the value of a currency reflects the state of the underlying macroeconomic environment in which the currency is traded.

As a result, a stronger economy will result in a stronger currency than a weaker economy, and vice versa. Fundamentalists often examine a country's economic prospects and predict whether its currency will grow or decline in value in the future.

These traders often monitor key economic announcements and reports to help them determine the value of the currency with which they are trading in order to maximize their profits. Economic calendars are often used to keep track of the most significant economic events. For example, the ForexPeaceArmy website offers a complete economic news calendar that may be used in conjunction with fundamental research to help you make trading decisions.

Usually, before a major economic statement is made, renowned economists from across the globe convene to get an agreement on the level of anticipation for that news. As a result, the future economic data will be compared to the consensus in order to establish the extent to which it will have an influence on the FX market.

The following are some of the most common categories for the report's release:

- As expected—the released statement was according to the expectations.

- Better-than-expected—the released statement was better than the expectations.

- Worse-than-expected—the released statement was worse than the expectations.

Traders' rapid opening and closing of positions as they try to determine if the disclosed report is higher or lower than the consensus level often results in more volatility in the market. In many cases, greater degrees of divergence between what is expected and what is actually delivered results in significant changes in the foreign exchange market.

If an economic report comes in better than predicted, it suggests that the country's economic outlook is optimistic, which might result in the linked currency gaining value compared to other currencies in the near future.

When a report is worse than predicted, it indicates that the country's economic outlook is poor, which might result in the depreciation of the currency that is being compared to the report.

The vast majority of fundamental traders feel that a report that is at or near the consensus level will almost always have a neutral impact.

Technical Analysis

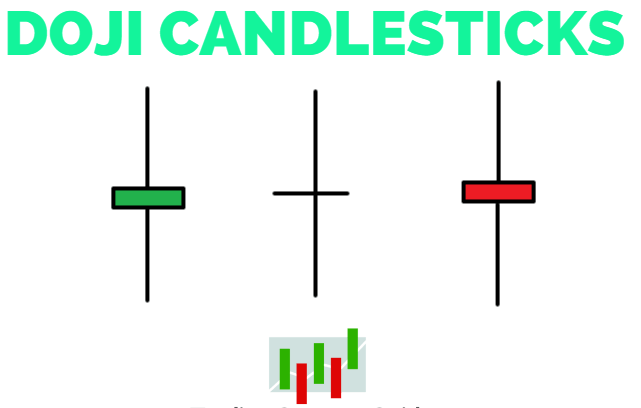

It is the goal of this form of study to evaluate historical market activity in order to predict the direction of currency values in the future. Followers of technical analysis depend on a variety of techniques and ideas to aid them in comprehending previous market events and spotting profitable trading opportunities.

Candlestick chart patterns, support and resistance levels, trendlines, and indicators like as moving averages and Fibonacci ratios are just a few of the approaches and instruments that are employed in technical analysis.

Three fundamental assumptions underpin the work of technical analysts. First and foremost, they place a great value on the supremacy of price action. Traders who believe that all of the fundamental variables that might influence the value of currency values have already been proved in the market's movements are known as fundamentalists. As a result, technical analysts are solely concerned with the price action shown on the charts and do not spend any time investigating the underlying reasons of the changes.

Second, technical experts point out that the swings of currency values are influenced by trends in the market. The three basic sorts of trends are an upwards trend (price is rising), a downward trend (price is declining), and a sideways trend (price is moving in the same direction as the market) (price is fluctuating without moving in any definite direction).

Following the establishment of a trend, technical analysts think that price action will typically follow the trend before shifting to a new trend. As a result, the typical technical analyst only puts trades in the direction of the current market trend, unless otherwise specified. "Trend is your friend," as the saying goes, and it is often used by traders to describe the current market conditions.

Another assumption is that history has a tendency to repeat itself. As technical analysts point out, market moves may be broken down into patterns that are likely to recur in the future. Because these movements are orderly, systematic, and predictable, traders are able to foresee the direction of currency values with a reasonable degree of accuracy as a result of their existence.

Sentiment Analysis

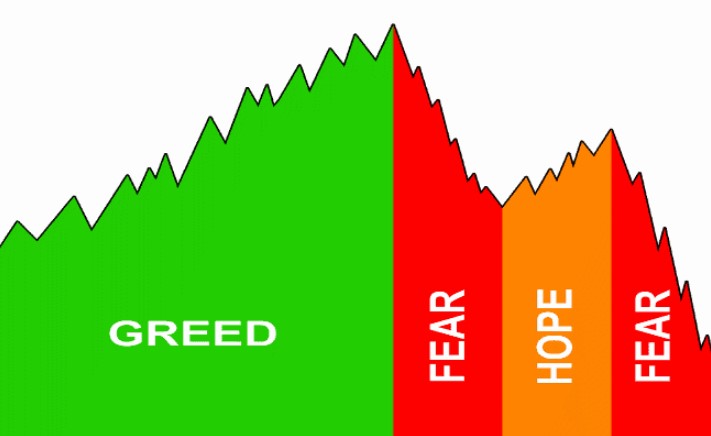

The third form of analysis is the comparative one. It entails identifying and assessing the dominating mood or attitude that market participants have toward the market.

Every market participant has his or her own opinions about the direction in which currency values are moving. They make judgments based on their opinions and viewpoints, such as whether to initiate long or short trades based on these considerations.

A mixture of all traders' emotions and preferences will eventually result in the currency market's dominant direction being reflected in the price of the currency. Suppose the EUR/USD is trending higher, which indicates that the majority of traders are optimistic on the currency pair at the time of the trend.

Because the vast majority of us are retail traders, it is difficult to influence the market in the direction we want it to go. In the case where you feel the pound is gaining, but everyone else is negative on the currency, you will be unable to prevent the decline unless you have enough money to trade large volumes of currencies on the foreign exchange market (forex).

Because of this, you must do sentiment analysis in order to aid you in identifying how to defeat the major players at their own game.

To determine if the market is bullish or bearish, you need do research and use the results into your trading plan. When you do a sentiment analysis on a currency pair, you can determine what the majority of traders are thinking about it and use that knowledge to make trading choices.

When trading using sentiment analysis, it is usual practice to enter transactions that are at odds with the prevailing market mood. As a result, emotion analyzers often do not follow the basic rule of trading, which is to make bets in accordance with the current market trend.

If the market is going aggressively in one way, emotion experts feel that the market has reached a point of saturation, and that a price reversal is set to occur as a result.

When a currency pair has been heading higher for a period of time (bullish sentiment), traders will consider it to be overbought and will place sell orders in anticipation of the pair's upcoming reversal.

For example, the Commitment of Traders (COT) report, which is produced by the Commodity Futures Trading Commission (CFTC), and the Relative Strength Index (RSI), which depicts overbought and oversold market situations, are two indicators that you may use to gauge market mood in the stock market.

How to Combine the Three Types of Analysis

Example 1

Let’s say you were looking for a trade opportunity in the below 4-hour chart of AUD/USD with the Fibonacci tool and the RSI indicator applied to it.

Fibonacci retracement levels are often employed in technical analysis to detect retracement levels in the market. As can be seen in the chart above, the currency pair had a decline in value, falling from 0.8135 on 26th January 2018 to 0.7761 on 9th February 2018, before beginning to rise again.

Initially, the AUD/USD pair was trading in the negative territory. As a result, if the price retraces from the swing low position, it is expected to encounter resistance at any of the Fibonacci levels that have been identified, allowing an opportunity to place a sell order. As a result, you might utilize the Fibonacci retracement tool to discover prospective places where you may put sell orders on the stock market.

Following the completion of the technical analysis, you will proceed to the fundamental analysis in order to support your trading choice.

Take a glance at the economic calendar and you will note that the Governor of the Reserve Bank of Australia (RBA) will be issuing a statement on the 16th of February, 2018. Such economic reports from Central Banks are typically closely followed since they have an impact on the value of the currencies they are linked with and may generate increased volatility in the market.

When asked about the future of the Reserve Bank of Australia's monetary policy decision, the Governor adopted a dovish attitude, which resulted in a precipitous drop in the value of the Australian dollar.

In light of the RBA governor's dovish stance on the country's interest rates, you now have an additional incentive to put a sell order on the AUD/USD currency pair.

You decide to look at the relative strength index (RSI) in order to give your trading choice even more weight. This indicator gauges the mood of the market on a scale ranging from 0 to 100.

A reading of the RSI line that falls between zero and thirty indicates that the currency pair has been oversold. If the line falls between 70 and 100, it indicates that the market has reached an overbought state of equilibrium.

In this particular instance, the RSI indicator indicates that the AUD/USD pair is closing in on the 70 level, indicating that a reversal is imminent—and that you should consider placing a sell order.

The following is a summary of your findings:

- Technical analysis: AUD/USD has found resistance at the 61.8% Fibonacci retracement level.

- Fundamental analysis: RBA’s governor made a dovish remark.

- Sentiment analysis: AUD/USD is approaching the overbought territory.

You then opt to sell AUD/USD on the 16th of February 2018 after integrating the three methods of forex research and observing how well they correlate with your trade idea.

As predicted by your research, the currency pair is expected to fall in the next several days.

Example 2

Here is a 4-hour chart of GBP/USD.

In the chart above, you can see that the currency pair is in the midst of a range, according to the technical analysis. In this case, two parallel trendlines were created to demonstrate that the GBP/USD was confined inside a horizontal trend.

Consider the following scenario: you intended to trade this currency pair, and you were waiting for an opportunity for the price to break out of its horizontal channel.

If the price is able to break through the top line of the channel (the resistance level), it may provide an opportunity to place a buy order. If, on the other hand, the price is able to break out of the support level, it may be a chance to place a sell order.

Following the completion of the technical analysis, you will go on to the fundamental analysis in order to refine your trade idea even more.

You take a peek at the economic calendar and see that the Manufacturing Production report for the United Kingdom is due to be issued on June 9th, 2017. As a result of its ability to quantify the value of items produced by manufacturers in the United Kingdom, high-impact news is considered to be one of the most reliable indicators of the country's economic health.

It was reported that 0.2 percent was achieved, which was lower than the anticipated number of 0.8 percent at the time of the report's publication. Because the news was worse than predicted, the value of the pound in the United Kingdom fell.

You decide to do an analysis of the current market mood in order to strengthen your trading hypothesis even more. When you looked at the relative strength index (RSI), you observed that the GBP/USD was nearing the 70 level, suggesting that bullish pressure was waning.

The following is a summary of your findings:

- Technical analysis: GBP/USD’s price action was confined to a horizontal range.

- Fundamental analysis: A worse-than-expected report from the U.K. made the pound to fall, resulting in GBP/USD breaking out the range.

- Sentiment analysis: GBP/USD was almost overbought, suggesting an imminent reversal.

Consequently, the currency pair slipped past the support level and broke out of the horizontal pattern, which provided you with an opportunity to enter a sell order.

Conclusion

The use of fundamental analysis, technical analysis, and sentiment analysis in conjunction with one another is critical for obtaining success in forex trading. Because every sort of analysis has its own set of advantages and disadvantages, focusing on a single approach is a certain prescription for catastrophe.

The finest of all three forms of analysis will be enjoyed if you combine distinct strategies from each type of analysis. You'll be able to add more weight to your trading selections and become a more effective trader if you use a combination of approaches.

As a result, refrain from adopting a solo method that employs just one form of analysis. Combining several forms of analysis will provide favorable outcomes, and the size of your trading account will reflect the magnitude of your gains.