AUD/USD Rate Outlook Hinges on RBA’s Forward Guidance for Policy

AUSTRALIAN DOLLAR TALKING POINTS

While approaching the October high (0.7556), the AUD/USD is attempting to break out of the range-bound price action that has been in place since last week. The Reserve Bank of Australia (RBA) interest rate decision, which is expected to be released on Wednesday, may add to the recent advance in the exchange rate if the central bank adjusts its forward guidance for monetary policy.

AUD/USD RATE OUTLOOK HINGES ON RBA’S FORWARD GUIDANCE FOR POLICY

The Australian Dollar has reached a new yearly high (0.7556) as commodity bloc currencies continue to outperform their major counterparts. The 50-Day Simple Moving Average (0.7267) has established a positive slope, suggesting that the Australian Dollar may attempt to retrace the decline from the June high (0.7775).

According to expectations, the Reserve Bank of Australia (RBA) will maintain the official cash rate (OCR) at 0.10 percent in April, as the board pledges to "not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range." More of the same from the central bank could derail the recent rally in the Australian dollar against the US dollar, as the Federal Reserve plans to deliver a series of rate hikes over the coming months.

But as Governor Philip Lowe acknowledges that "it is plausible that the cash rate will be increased later this year," the RBA may prepare Australian households and businesses for a looming shift in monetary policy, and a shift in the forward guidance may lead to a near-term breakout in the AUD/USD, which is currently testing the October high (0.7556).

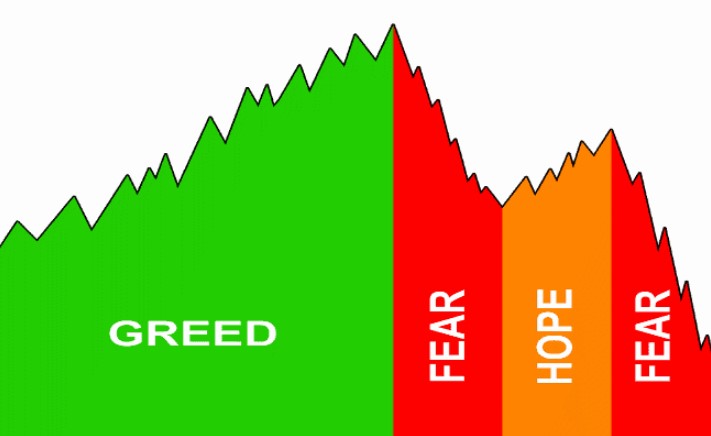

Thus, the Australian dollar may seek to reverse the loss from its June high (0.7775), but a further rise in the exchange rate might exacerbate the current flip in attitude, similar to the behavior exhibited during the previous year.

According to the IG Client Sentiment survey, just 30.56 percent of traders are now net-long the Australian dollar against the US dollar, with the ratio of traders short to long standing at 2.27 to 1.

There are 1.55 percent more traders net-long today than there were yesterday and 5.31 percent more traders net-short than there were last week, while there are 13.35 percent more traders net-short today than there were yesterday and 11.23 percent more traders short last week.

In addition, the increase in net-long position comes as the AUD/USD appears to be breaking out of a narrow range, while the increase in net-short interest suggests that the crowding behavior will continue over the next few days, as 30.76 percent of traders were net-long the pair last week, according to data from Bloomberg.

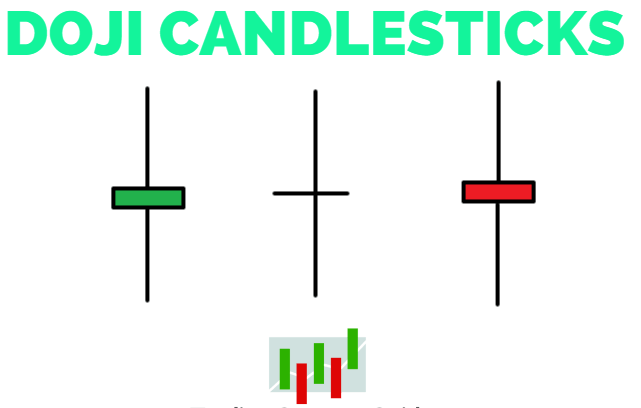

The RBA rate decision, if the central bank demonstrates a greater willingness to switch gears, may serve to fuel the recent advance in the AUD/USD, but the failure to clear the October high (0.7556) may result in a near-term pullback in the exchange rate, especially if the Relative Strength Index (RSI) remains below overbought territory.

AUD/USD RATE DAILY CHART

- AUD/USD has come up against the October high (0.7556) as it trades above the 200-Day SMA (0.7296) for the first time since June 2021, with a break/close above the 0.7560 (50% expansion) to 0.7570 (78.6% retracement) area bringing the 0.7640 (38.2% retracement) region on the radar.

- Next area of interest comes in around 0.7720 (38.2% expansion) to 0.7740 (61.8% expansion) followed by the June high (0.7775), but lack of momentum to clear the October high (0.7556) may lead to a near-term pullback in AUD/USD as the recent rally in the exchange rate fails to push the Relative Strength Index (RSI)into overbought territory.

- Failure to hold above the 0.7440 (23.6% expansion) region may push AUD/USD back towards 0.7370 (38.2% expansion), with a move below the 200-Day SMA (0.7296) bringing the 0.7260 (38.2% expansion) area back on the radar.

Written by Kevin Smith, Currency Strategist