6 Common Crypto Scams And How To Avoid Them

The bitcoin sector is still pretty new and uncontrolled. That plus the fact that crypto is very portable, liquid, and comes with irreversible transactions makes it an enticing asset to thieves.

As a consequence, a vast assortment of frauds has entered the crypto and digital world. From the decades-old classic to crypto-specific schemes, thieves are growing more skilled in deceiving investors. They do it using several fraud strategies and scams that try to drain their hard-earned money or access their crypto wallets.

To help you remain secure, this post covers some of the most prevalent crypto scams and how you can prevent them.

Unregulated Brokers

When you initially start out in the cryptocurrency world, one of the most important things to consider is who you are putting your confidence in to manage your portfolio.

Since Bitcoin, Ethereum, and other cryptocurrencies and crypto projects began to gain pace, the number of cryptocurrency exchange platforms and crypto brokers has been steadily increasing.

CoinMarketCap, for example, has over 300 cryptocurrency exchanges listed on its website.

According to the data, the largest cryptocurrency exchanges include Binance, Mandala Exchange, OKX, Deepcoin, CoinFLEX, and Coinbase, to name a few.

Additionally, there are cryptocurrency brokers who have been associated with incidents involving stolen funds and hacked systems, which have resulted in multimillion-dollar losses for investors. These brokers can be found alongside the numerous trusted exchanges, such as these sites, that have proven to be legitimate and established a reputable track record.

In the majority of situations, these brokers are not subject to the same kind of regulatory monitoring that most legitimate cryptocurrency trading platforms are. As a result, you should exercise caution while signing up for and placing your money into these exchangers. Look into if the broker is actively supervised by top-tier nations such as the United States, the United Kingdom, Australia, or Japan.

Also, avoid being seduced by their offers that seem too good to be true. Low costs, rapid returns, and competitive trading goods are some of the ways that these unregulated cryptocurrency exchanges and brokers entice their customers.

The process of withdrawing your money gets more complex after you have made a deposit. They may invent fictitious reasons why you are unable to take your profit or cash, or they may demand excessive fees. The worst-case situation is that you will be unable to reach them and would thus lose all of your money.

Social Media Giveaways

Giveaways are a favorite of many people.

It's astonishing how kind everyone seems to be these days, especially on social media sites like Facebook and Twitter. If you look in the comments or answers on popular Facebook posts or tweets, particularly those that are crypto-related, you'll almost certainly find someone who is giving away your favorite cryptocurrency.

A crypto asset such as 5,000 DOGE coins will be requested and they will offer to deliver you twice as much money in exchange for your contribution. This is just another example of something that seems to be too wonderful to be true. It's quite rare that someone organizing a legitimate contest would first ask you to send in an asset of your own before accepting your entry. As a result, you should be on the lookout for postings and messages of this kind on social media.

Additionally, some fraudsters deepen their deception by imitating well-known figures in the financial and cryptocurrency industries, celebrities, or other persons whose reputation is strong enough to lead consumers to believe that their offer is legitimate.

People and other users will even leave nice comments on the aforementioned post, which will be visible to you. However, they are often the fraudsters themselves, who use bots and bogus accounts to conduct their operations.

Some individuals even go so far as to hack into a person's legitimate social media page, which is very dangerous. A case in point is the hacking of the Twitter accounts of famous US leaders like as Jeff Bezos, Elon Musk, Bill Gates, and even former US President Barack Obama in 2020, which was used to solicit donations of cryptocurrency assets in return for larger rewards.

The bottom takeaway is that you should just disregard these kind of postings or communications. If you're still not persuaded that they're legitimate, look at their profiles and you'll instantly see the discrepancies. Even if a well-known individual or cryptocurrency exchange does arrange a giveaway, the legitimate ones will never need you to contribute money in advance.

DeFi Rug Pulls

This is the most recent sort of fraud to plague the cryptocurrency business, according to the FBI. Decentralized finance (abbreviated as DeFi) is a movement that aims to disperse finance by eliminating the need for intermediaries in financial transactions.

It has provided a platform for innovation in the cryptocurrency sector. The rise of DeFi platforms, on the other hand, has also brought with it a new wave of fraud and frauds. Malicious actors have taken use of such opportunities to defraud a number of investment funds. The practice of rug pulling in particular has grown more popular as DeFi protocols have drawn the attention of crypto investors looking to increase their earnings by investing in yield-bearing crypto products.

The following is how a rug pull occurs:

Malicious actors create a new token and offer it on decentralized exchanges, after which they couple it with legitimate cryptocurrency. They'll generate attention on social media, which will help them recruit investors. Once a sufficient amount of money has been invested in their token, the creators will abandon the project and run off with your money.

Early or beginner investors who believe they are receiving early access to forthcoming cryptocurrencies are the most common targets of this fraud. It is essential that you pay careful attention to the third parties and websites involved in order to avoid this from happening. You should not depend on other people's opinions on social media, regardless of how many favorable ratings it has received in the past. You should be cautious if you cannot locate any respectable or genuine reviews since it is quite possible that the site is a fraud.

Ponzi And Pyramid Schemes

Ponzi and pyramid schemes are two types of Ponzi scams that are somewhat different. However, they are mostly similar in terms of their end goal—to recruit new members with the promise of high profits in order to keep the model afloat. They are also similar in terms of their methods of recruitment.

Despite the fact that Ponzi and pyramid schemes are popular among enterprises in the beauty and health industries, they may also be found in the investing sector, including the cryptocurrency sector.

In fact, contentious initiatives such as Bitconnec, OneCoin, and PlusToken are being criticized for allegedly using pyramid schemes in their business models. The Chinese cryptocurrency Ponzi scam Wotoken, which reportedly took more than $1 billion from investors in 2020, is yet another example.

But what precisely are these schemes, and how do they work? Let's take a closer look at what we've got:

-

Ponzi

A Ponzi scheme guarantees you a guaranteed return on your money if you participate. It is often posed as a portfolio management service to confuse the public. In contrast, instead of managing your portfolio to generate profits, the returns you get are simply the money of other investors.

This implies that any additional money that is put to the pool comes from new participants. The money from new investors is used to repay the money owed to the older investors. This cycle continues as additional people are welcomed. As a result, if the organizer is unable to attract new investors and maintain payments to current investors, the scheme will come crashing down.

For example, a supposed cryptocurrency investor or manager may guarantee you 15 percent monthly returns in exchange for your money being invested in cryptocurrency assets. As a result, if you pay them USD$100, you may expect to get $115 at the end of each month.

As an alternative to actually investing your money in cryptocurrency, the fraudster will just recruit yet another customer to join their scheme and spend another USD$100, which they will use to make a payment to you at the conclusion of the month. They would then enlist the assistance of another customer to pay the second, and the cycle would continue.

-

Pyramid Schemes

Pyramid schemes, as opposed to Ponzi schemes, will need greater work on the part of the participants. The program organizer is at the very top of the list. They will hire a particular number of people to work at a lower level than they are already employed. Next, every single one of those persons will attract a similar number of others, and so on.

After a while, you'll have a massive edifice that rises exponentially as more layers are added, earning the name pyramid.

However, despite the fact that it seems to be a legitimate, significant company, pyramid schemes may be differentiated by the fact that they guarantee income in exchange for successfully recruiting new members.

For example, the program organizer has two new recruits, designated as A and B. When A and B recruit additional participants for the program, the organizer offers to pay them USD$50 apiece, but he also gets a 50 percent share of the total revenue from the program. Because half of her money will be distributed to the organizer, if A recruits both C and D (at USD$50 each), he will be left with USD$50.

Each of the two companies may offer the identical deal to their respective recruits, but each will require at least two recruits in order to recoup their original investment. If both C and D continue to recruit new members, the incentives will rise in value: A will get half of the income generated by both C and D, and the program organizer will receive half of A's half.

Older members may benefit from the scheme's growth by earning a passive, steadily rising source of earnings. However, owing to exponential growth, it is not a model that can be maintained for an extended period of time.

The most straightforward strategy to avoid being a victim of this sort of cryptocurrency fraud is to avoid participating in any marketing or program that seems to be a Ponzi or pyramid scheme. Also, be sure you obtain all of the necessary information about the program and the firm. Check to see whether the investment is registered and to double-check with regulatory agencies such as the SEC, IRS, and CFTC.

Pump And Dump Schemes

Pump and dump scams have been around for a long time. In reality, this form of scam is claimed to have originated in the 18th century and has continued to exist in the crypto-currency industry.

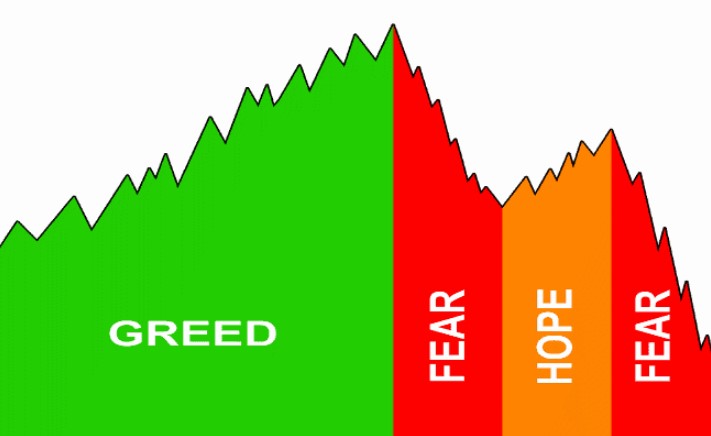

Typically, this sort of scam begins with the efforts of a person or an online group to inflate or "pump" the price of a cryptocurrency asset. They will persuade investors, especially newcomers, to invest in a cryptocurrency asset. Scammers often utilize social media and online forum groups to disseminate misleading or fake information, or to give persuasive analysis that predicts an upcoming boom in order to convince investors to purchase and maintain their positions in the market.

After pumping, the waste is disposed of. As other investors get more persuaded, purchasing and pushing the price up, the schemers sell off their shares and earn a fast fortune in the heat of the moment. The moment consumers discover that the hoopla was unfounded, they would panic and sell off their assets in an attempt to minimize their losses. The cryptocurrency's value plummets as a result of the massive sell-off.

In July 2021, a typical crypto pump-and-dump fraud was perpetrated, and the results were disastrous.

Members of the FaZe clan, who are professional gamers, as well as other social influencers, distributed the token "SaveTheChildren" to their respective audiences. Once the price increased, people began to sell their tokens, with some earning as much as USD$30,000 on the transaction.

Probably the most aggravating aspect of this situation is that pump-and-dump techniques are not technically unlawful. This is due to the fact that cryptocurrency is largely unregulated and does not follow the same laws as equities.

As a result, it is advisable to understand how to prevent falling victim to such a scam. The ability to recognize a pump-and-dump scam comes down to a matter of credibility. If you're tracking cryptocurrency movements on social media sites such as Twitter and Reddit, avoid anonymous accounts with little or no posting history, and keep an eye out for individuals who have a history of pumping coins without any basis in fact. Also, be aware of influencers who seldom discuss cryptocurrency but then suddenly start pushing a certain cryptocurrency coin. Finally, don't be swayed by the "fear of missing out" (FOMO) movement; always do your own research and learning, and adhere to your investing strategy.

Classic Phishing

Even if you don't work in the crypto area, you're definitely familiar with the concept of phishing. Phishing scams include a fraudster pretending to be someone or something in order to get personal information from you. Mental manipulation is another technique used by phishing fraudsters to deceive you into divulging your login passwords or financial information.

Phishing may take place via a variety of channels, including email and chat applications, as well as bogus websites. In particular, messaging applications and email phishing schemes are quite popular in the cryptocurrency sector. In specifically,

It is important to understand that there is no one playbook that these fraudsters use while attempting to get your personal information. You may get a text message informing you that something is wrong with your broker account, or you may receive an email informing you that you have won some coins. They are often accompanied by a link that will send you to a bogus website and request you to enter your login information. And if you do log in, the fraudster will be able to access your cryptocurrency wealth as a result.

Some tips to avoid being scammed by phishers include:

- Always check the URL of the sites you’re visiting.

- Never give your password or OTPs. Legitimate crypto exchange will never ask these of you.

- Bookmark your frequently visited websites.

- When in doubt, ignore the message you received and contact the crypto exchange or business via their official channels.

- Same as passwords and OTPs, nobody needs to know about your seed phrase or private keys.

Takeaway

The frantic rush into cryptos has invoked images of the Wild West that many people are acquainted with. As the crypto-world develops and gets more complicated, the scamming agenda of malevolent persons and cybercriminals will also expand and become more sophisticated.

Despite the fact that it is frightening, you should not let this deter you from investing in and reaping enormous rewards in the cryptocurrency market. Maintain vigilance and get familiar with the typical methods used by hackers and fraudsters to defraud you. If you follow these steps, you will hopefully be able to actively identify a cryptocurrency-related fraudulent offering and prevent it from occurring to you.