10 Secrets The Trading Industry Doesn’t Want You To Know About

Today's lesson is going to be a little contentious, and it's possible that it may ruffle a few feathers. Many of the pieces of information you have most likely been exposed to so far in your trading career will be blown wide open and debunked by me.

Average traders are faced with a complicated and contradicting tangle of information coming from a range of different sources, including but not limited to: blogs, forums, broker websites; books; e-books; courses; and YouTube videos, among others.

With all of the learning resources available, it is inevitable that some very good and some very bad information will be shared; however, in reality, most aspiring traders have no way of knowing what to listen to, who to listen to, or what information is beneficial and what information is not beneficial.

No, I'm not going to make any claims that there is some kind of filter that a prospective trader can use to sort through the vast amount of information generated by all of the resources and mentors available, since there just isn't one. If a skilled trader has 10,000 hours of experience, he or she may be able to tell the difference between what is excellent and what is poor and what is legitimate and invalid. However, as a rookie or intermediate trader, you will simply lack the capacity to filter out irrelevant information.

Becoming ‘Non-Average’

Our natural sentiments of social trustworthiness are based on what we see and hear, and as traders, we frequently give in to these instincts to our tremendous harm. The majority of the time, we have a tendency to put our trust in our mentors and to accept what they say at face value. Our natural tendency is to hold on to information that resonates with us and makes sense to us, particularly if it is presented by a familiar source that we have grown to know and trust over time.

Because of the strong desire to earn money and be free, the 'typical trader's brain' is always on the lookout for methods to cut corners. The brain desires to get a successful outcome as quickly as possible with the least amount of effort. To succeed as a professional trader or investor, I recommend that you do all in your power to avoid thinking with the "average trader's brain" and start thinking with the "non-average trader's brain." In practice, this entails being considerably more attentive, expanding your thinking beyond the traditional boundaries, and questioning and filtering the information you consume. Most significantly, everything is being slowed down!

This raises the obvious question: how do you know that what I'm going to write in this lesson is genuinely legitimate and truthful, given the lack of evidence? What is the best way to know for certain? The fact is that unless you've been following me and my writings on this site for a long time, and you're familiar with me and my work, you can't be certain, and I don't expect you to take my words at face value without further investigation. If you need to come back and re-read this lesson in a few weeks, or a few months, or a few years after you've determined whether I am someone worth listening to about trading, or whether I am someone not worth listening to about trading, that's OK with me; it's your decision.

So, with a healthy dose of skepticism, I invite you to study the following list of eye-opening truths that professional traders and the trading business do not want you to be aware of or comprehend. I hope it is of assistance.

FOREX isn’t the only market the Professionals trade

The foreign exchange market is enormous, with billions of dollars changing hands every day. In the right hands, it may bring in big bucks, or it might leave you bankrupt in the wrong hands, depending on your knowledge and experience. It is a highly popular market to trade on a worldwide scale, but it is not the only market in which professionals deal, and it is not necessarily the simplest market to trade on as a result.

A note on leverage:

Because the profit margins for the brokers and platform providers are so substantial, they encourage you to trade foreign exchange using heavy leverage. However, if you trade foreign exchange on a lesser level of leverage, your profit margins will fall considerably. Think on what may go wrong when trading foreign exchange rather than just about what can go well when trading foreign exchange. As a general rule, I recommend that you avoid using excessive leverage such since 400 to 1, as this may be very risky for you if the market moves fast or encounters a price gap, and your stop-loss orders are not executed at the price you specify. A more reasonable leverage level might be 100 to 1 or 200 to 1, but anything more than that seems to be insane. (Using excessive leverage was the cause of many traders' losses during the Swiss Bank Crisis in 2015, the Brexit vote in 2016, and the Currency flash collapse in early 2019.)

Broaden your view:

Starting now, it will be beneficial to you in your trading career to keep an eye on a range of global markets, including the foreign exchange market, stock indices, and commodities. I personally trade GOLD (XAUUSD), the S&P500 Index USA, the SPI200 Index Australia, and the Hang Seng Index Hong Kong, as well as individual stocks on numerous worldwide exchanges, in addition to forex trading. In summary, the trading world encompasses much more than simply foreign exchange. The most common markets that I trade are discussed in this section of the video tutorial.

Day trading isn’t what Pro trading really is !

A great deal of marketing is devoted to convincing people that a trader is someone who spends the majority of his or her time actively trading in and out of the market on a short-term basis, all while enjoying the lifestyle of a Wall Street billionaire. But this isn't the case. In the entertainment business, there is a strong goal to get this tale in front of as many people as possible, and it has been working relentlessly for decades.

So far, I have not met a single successful day trader who has maintained consistency over the long term, yet this site has more than 25,000 students and 250,000 visitors. Certainly, there are some successful day traders out there, but 99.9 percent of those who attempt to follow in their footsteps or live up to the usual day trader reputation will fail and may even injure themselves financially or psychologically. A obsessive trader playing roulette at a casino all day is the same of sitting in front of a computer screen all day searching for opportunities.

Higher time frames and longer time horizons, according to the successful traders I know (including myself), are the keys to success (minimum 4-hour chart timeframes and predominantly daily chart time frames). Because they have no time limit on how long they are seeking for deals, they prefer to let the trades find them rather than forcing themselves on them. They do not day trade, they do not sit in front of screens all day, and they do not seek for trades all of the time, according to the pros I know. Their trading style will usually be classified as either swing trading, trend trading, or position trading.

With the 'day trader narrative,' the evident contradiction and contradictory reality are immediately apparent. How can a trader who is continuously staring at a computer screen and continually trading find time to enjoy his life and live the lifestyle he desires? Rather of choosing to trade as a job so that they could have a life, they decided to trade so that they could sit in front of a screen 24 hours a day, five days per week.

Here are some points to consider that work against the so-called ‘ day trader’:

- The shorter the time frame the more noise and random price movement there is, thus increasing your chance of simply being stopped out of the trade.

- Your ‘trading edge’ has a higher chance of yielding a result for you if you’re not trading within the intraday noise.

- The same trading edge does not work or produce the same results on a 5 min chart compared to a Daily chart.

- Commissions and spreads churn your account, so the more you trade the more you lose in broker platform costs. (I will talk about this below)

- Risk-Reward ratios are not relative on shorter and longer time frames. Statistical average volatility across different time periods as well as natural market dynamics play a huge role in this. There is far more weight behind higher time frames than lower timeframes.

- Great trades take time because the market moves slower than most people ever anticipate. Trading from the higher timeframes and holding trades for longer time periods will offer you greater opportunities to see trades mature into big winners. However, shorter timeframes don’t offer you this same opportunity very often.

Commissions, Spreads & Swaps eat into your profits

I briefly mentioned the "hidden expenses" of trading in the previous section. It is not always evident to a rookie trader that for every 100 transactions they execute, they will incur around 70 to 100 pips comparable charges as a result of the broker's price spread, commission, and overnight swap fees, among other things. It's going to mount up rapidly if you're day trading, and it's going to eat away at your account (the industry term for this is 'churn'). Every second lesson I seem to post on this site is on the advantages of trading less often, trading daily time frames, slowing it all down, and allowing deals to play out over a longer period of time than usual. Listed here is one of my most valuable lessons on trading the daily time periods.

There is no such thing as an ECN broker for retail traders

An epidemic of total B.S marketing is spreading among brokers that identify themselves as 'ECN brokers' or "True ECNs," and who attempt to portray themselves as "more genuine" or "more transparent" than their competition brokers is sweeping the industry. I get questions regarding ECNs on a daily basis via our email support line, and my reaction is always direct and honest as I attempt to convey the truth of what is actually going on here.

Now, let me to explain the reality of ECN broker accounts...

In the banking and financial services business, the word "ECN" refers to a "Electronic Communication Network," which is essentially simply an abbreviation for "Electronic Communication Network." It indicates that your broker's order is submitted straight to the market, bypassing any middlemen and avoiding any market-making activities on the part of the broker. However, the reality is that 99.9 percent of all brokers and platforms are market makers, and they are not always transmitting your transactions to a bank or liquidity provider at any point in time.

Unlike the stock market, there is no central exchange where one trader's order is matched with another trader's order in the forex market, and the prices in the forex market are referred to be "market produced OTC goods." Banks, financial institutions, and brokers are the ones that develop these products and set their rates. Even when dealing with a so-called ECN broker, there is no central exchange and no true transparency when it comes to foreign currency and CFDs.

Undeniable Proof:

Recent events have seen one of the biggest brokers in the world, which had claimed to be a 'True ECN,' delete this language from their website and no longer claims to be an ECN broker! According to rumors, the broker was ordered to delete this language off their website by a number of international authorities for deceiving consumers. Despite the fact that I had been warning our members about this broker for years, I had always had difficulty convincing them that it was just really effective marketing. Throughout the whole process, these ECN brokers continued to market-make a portion of the order flow originating from customers and did not always send every transaction through to the banks or liquidity providers, as required by law.

Although it is possible if they sent every deal through to the banks or liquidity providers'magically,' you would still have no idea what was happening on the other side. Every time a market is created, there is ALWAYS an institution or corporation doing so (settings the prices you trade on). Regardless of the bank or broker you choose, the pricing is never the same. There is also no central exchange where prices can be compared or disputes over pricing may be resolved.

In summary, do not give a broker a better rating just because they employ terms such as ECN, STP, or DMA in their name. Of course, there are some excellent brokers out there, but don't be foolish or tricked by slick marketing and pick one only on the basis of the tale they are selling you. When trading on the over-the-counter market, a bank or broker somewhere is always taking the opposing side of the deal; there are no exceptions to this rule.

The ideal way to choose a broker is to consider factors such as regulatory restrictions, worldwide presence, payment and banking conditions, customer service and general reputation in the business before making a decision.

Market Makers are not always a bad thing, and we need them too

When trading in a 'over-the-counter market,' such as foreign exchange or CFDs, the counter parties are a bank, an institution, a broker, or a liquidity price provider who takes the opposing side of the deal. Did you realize that banks are also involved in the market-making process? It's surprising how much respect and credit are accorded to banks, considering that they are, at the end of the day, nothing more than extremely big brokers. A qualified foreign exchange broker who makes a market rather than sending every deal through to a bank is not inherently incorrect. Consider the implications of that for a second... However, if a broker sends your transaction through to a bank or major institution, they are just putting it through to a market maker!

The truth is that this is an enormous misunderstanding. In reality, what you may not be aware of is that you will often get a cheaper pricing and a better experience when dealing with this kind of supplier. This is supposing that the broker is reputable, has worldwide offices and a global customer base (both of which are licensed), and, based on your own testing, is providing satisfactory order execution and trading conditions to its clients.

Other benefits of Market Makers:

- You can trade very small lot sizes, whereas you can’t if going direct to the banks.

- You will often get tighter/better spreads.

- You will often experience better order execution and speed of execution (better fill price on orders)

- You can often access a broader range of markets including Cash CFD’s as apposed to just Futures CFD’s. (overnight swap vs monthly swap)

While it may seem that the broker is assuming less risk by forming a market, there are actually more expenses and a greater risk to the bank's balance sheet when every deal is routed via the bank. This is really why some retail brokers survived the Swiss Bank crisis in 2015 while others did not; it all came down to the brokerage model that they were using at the time of the crisis.

A Quick Note On The FX Broker Platform We Use:

We now operate with an Australian registered and respected worldwide broker providing FX, CFD’s, Metals & Commodities. More importantly, they provide the right charts, which I and our members utilize to trade the price action tactics that I teach in our courses, which is very crucial (ie: New York Close Charts). You may take a test drive of this FX Broker Platform by clicking here. (This will save you the trouble of emailing me to ask for the link.)

Trading is simple, BUT it’s really not easy

For those of you who believe that trading is a get rich scam, you should definitely exit this site right now and never return. Please continue reading if you believe in the value of hard effort, continual study, and learning via life experience and the "school of hard knocks."

The process of finding and placing trades is really rather straightforward if you have a trading plan in place and have learned and mastered your trading method; nevertheless, it is not a 'easy' activity to handle on a day-to-day basis in any manner. Humans did not develop to sit in front of screens and watch price bars, or to place bets on whether those price bars would rise or fall in value. As a matter of fact, it is perhaps the farthest thing from what humans were originally intended to accomplish.

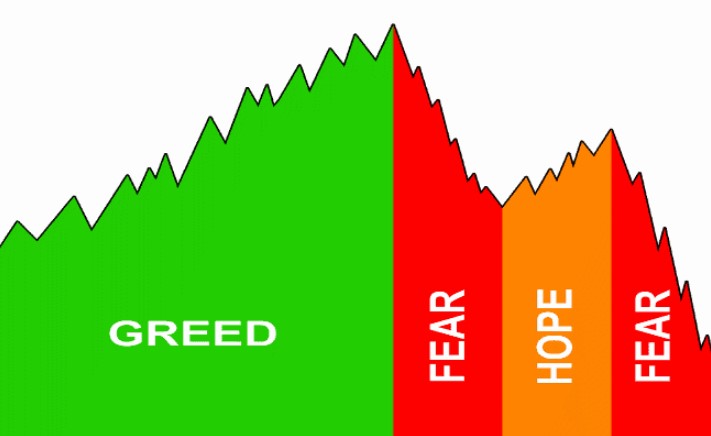

Virtually every price tick, every trade entry or exit, and almost every trading choice we make causes our minds to battle with the emotional roller coaster that we are forced to ride on almost every trading decision we make. We are doomed as traders and investors until we learn to control this feeling and impose horrible military-grade discipline on ourselves and our businesses. The typical human being will never find trading or watching a professional sports event to be a simple experience, no matter how many years they have spent in the trenches (10 or 20 years).

Although the game may seem simple, it is never 'easy' to play. Trading, like everything else that earns substantial money or provides a life-changing outcome, will not be without its challenges, and there will be hurdles to entrance, both emotionally and financially, that must be overcome.

Trading robots and EAs don’t usually work

My trading career has spanned over 18 years, and I have yet to see a single EA (expert advisor robot for MetaTrader) or automated trading strategy that regularly makes money. Automated trading systems and robots on retail trading platforms are very seldom successful in terms of maintaining profitability over an extended period of time. This is not a personal view; rather, it is based on industry figures. They claim that just 5 to 10 percent of traders are successful, and that the percentage of traders who are successful while using robots/systems is much smaller. Unfortunately, some of the most popular trading robots/are EA's using poor money management techniques (some are even using martingale, doubling up on positions when they lose), which can result in a significant drawdown in the trading account when the system experiences a string of losses over a short period of time.

The use of automated robots/EAs in conjunction with snake oil sales tactics is by far one of the most deplorable forms of marketing that has ever been seen on the internet. We're talking about outright scams, outright falsehoods, and outright b.s. Certain robots/EAs do earn money, and there will always be a few of them, but the odds are that you will not be trading the one that was developed by a NASA scientist geek, since the NASA scientist geek will not give away a robot that generates automatic income. Brokers prefer EAs above any other sort of client because they flip over a client's account regularly and generate more trading commission and spread money for the broker than any other form of customer. Keep in mind that every 100 transactions costs around 70 to 100 pips, which adds up quickly.

Yet another important point to remember: never, under any circumstances, give money to any broker or someone that offers to trade an EA or automated system for you; you will almost never get your money back. If you're going to run an EA at any point in your life, always retain complete control over it and keep a close eye on it.

Beware of those selling you ‘shortcuts’

There are several trading courses, techniques, and tactics available for sale to aspiring traders, all of which promise to be able to teach them how to print money, leave their jobs, and improve their lives. The popularity of social media channels such as Instagram, Facebook, and other platforms has increased the prevalence and effectiveness of this marketing tactic, which is being used to attract traders and take advantage of their inner greed as well as the brain's obsessive desire to find the quickest way to achieve a result (mentioned earlier).

I, too, was a victim of similar traps when I was younger and more innocent, so don't be too hard on yourself if this has already happened to you. Remember that you should never put your faith in anybody who promises you any form of financial outcomes or returns; if they do, go in the other way immediately. Sometimes you won't be able to walk away from an encounter like that since it's a true minefield. It is both alarming and heartbreaking to hear some of the tales I hear about traders who have spent large sums of money with'so-called experts,' both purchasing courses and investing in managed accounts with these traders (all of the bolt-on upsell offers). Don't let yourself get taken in by it!

Sure, I understand what you're thinking right now: "Hey Nial, don't you sell a trading course?" and my answer is yes, I do, and no, I'm not going to pretend that I'm not selling anything because in a capitalist world, I simply have to charge something for all of the time I spend composing education materials, writing daily newsletters, and responding to all of your emails each day:). The most significant distinction is that I do not participate in dishonest and bombastic marketing methods, nor do I make any financial promises or attempt to fool individuals about the reality of the trading industry.

To choose a mentor or information resource, you must be very picky and screen individuals based on how much they will do for you for free, as opposed to what they offer to do for money later on in the process. I first began my trading blog in 2008 as a passion project to share my views with other traders and to network with other traders. I had no intention of charging anybody for anything (which is why a lot of the information is still available for free to everyone). It has always been my aim that I, as well as this site, would be able to provide aspiring traders like you with the appropriate mix of free and paid material, as well as contribute actual value to your life.

Even the best mentors are not enough

Given that you have come to learn about trading from a professional trader, you may be disappointed to realize that neither I nor any other trading mentor or course has the capacity to turn you become a consistently winning trader or to alter your life. I apologize in advance for your disappointment. Even if I provided you with the most effective trading method known to man, and even if I demonstrated that it worked seven times out of ten, it would still not be enough to ensure your success. When you think like this, you're living in a pipe dream. It's absolutely impractical, and if you're still thinking like this after reading a few books and courses and after experiencing real-world trading on a live account, you need to have your mind examined.

If you have been trading for some time and have purchased courses or books, you are probably aware that while these products/services (including mine) can be extremely beneficial in terms of increasing your trading knowledge and skillset, they will not be sufficient in and of themselves to transform you into a consistently profitable trader.

The missing component in this equation is real-world experience in front of screens over an extended period of time (note the emphasis on the word "long" here). Trading experience, as well as the intuition and gut sensations that come with it, cannot be bought; rather, it is something that must be lived through in real time and experienced for oneself in order to be understood. Some people believe that you need 10,000 hours of trading experience to become an expert, and I do not disagree with them.

The cost of education is irrelevant

Note that the cost of a higher-priced education vs a lower-priced education in any profession has absolutely no influence on the quality of the material or on the legitimacy of the person who is educating the students. As of 2019, we have about 25,000 students enrolled at LTTTM, all of whom have spent just a few hundred dollars for our professional trading course, and many of them have told us that it is the greatest and most affordable course they have ever attended. In my own experience, I've read $10 books from Amazon that are among the best sources of trading and investing information available elsewhere on the earth (we are talking life-changing aha moments). As you can see, high-quality sources of information are not necessarily prohibitively costly.

The vast majority of the world's self-made affluent and elite did not attend or complete university, nor did they fork out large amounts of money for a prestigious degree. They acquired a lust for achievement as well as a lust for education, and once you catch the 'bug,' nothing can stand in the way of your progress. With Google, easy access to books and inexpensive courses all over the internet, you are living in one of the most advantageous periods in the history of the world to begin learning about business, investing, and trading strategies. No amount of money spent on a degree or training course will ever be able to teach you what real-world experience can teach you, and in a far shorter period of time as well.

If you want to succeed in trading for the rest of your life, never suppose or believe that you will obtain more by spending more. Just as I said above, I routinely receive tales from our supporters and members who have spent significant amounts of money on courses, seminars, software, and/or investing in the educational managed account service, among other things. These are scenarios in which a trader physically ends up spending so much money that they never have enough money left over to even begin to establish a live trading account in the first place. They have successfully completed their task before they have even begun. According to my opinion, it would have been preferable to utilize all of that money to invest in your own real trading account, where you would at least have a possibility of generating money while also learning something useful along the way. It's better to have money in your pocket than someone else's!

Conclusion

Note that the cost of a higher-priced education vs a lower-priced education in any profession has absolutely no influence on the quality of the material or on the legitimacy of the person who is educating the students. As of 2019, we have about 25,000 students enrolled at LTTTM, all of whom have spent just a few hundred dollars for our professional trading course, and many of them have told us that it is the greatest and most affordable course they have ever attended. In my own experience, I've read $10 books from Amazon that are among the best sources of trading and investing information available elsewhere on the earth (we are talking life-changing aha moments). As you can see, high-quality sources of information are not necessarily prohibitively costly.

The vast majority of the world's self-made affluent and elite did not attend or complete university, nor did they fork out large amounts of money for a prestigious degree. They acquired a lust for achievement as well as a lust for education, and once you catch the 'bug,' nothing can stand in the way of your progress. With Google, easy access to books and inexpensive courses all over the internet, you are living in one of the most advantageous periods in the history of the world to begin learning about business, investing, and trading strategies. No amount of money spent on a degree or training course will ever be able to teach you what real-world experience can teach you, and in a far shorter period of time as well.

If you want to succeed in trading for the rest of your life, never suppose or believe that you will obtain more by spending more. Just as I said above, I routinely receive tales from our supporters and members who have spent significant amounts of money on courses, seminars, software, and/or investing in the educational managed account service, among other things. These are scenarios in which a trader physically ends up spending so much money that they never have enough money left over to even begin to establish a live trading account in the first place. They have successfully completed their task before they have even begun. According to my opinion, it would have been preferable to utilize all of that money to invest in your own real trading account, where you would at least have a possibility of generating money while also learning something useful along the way. It's better to have money in your pocket than someone else's!